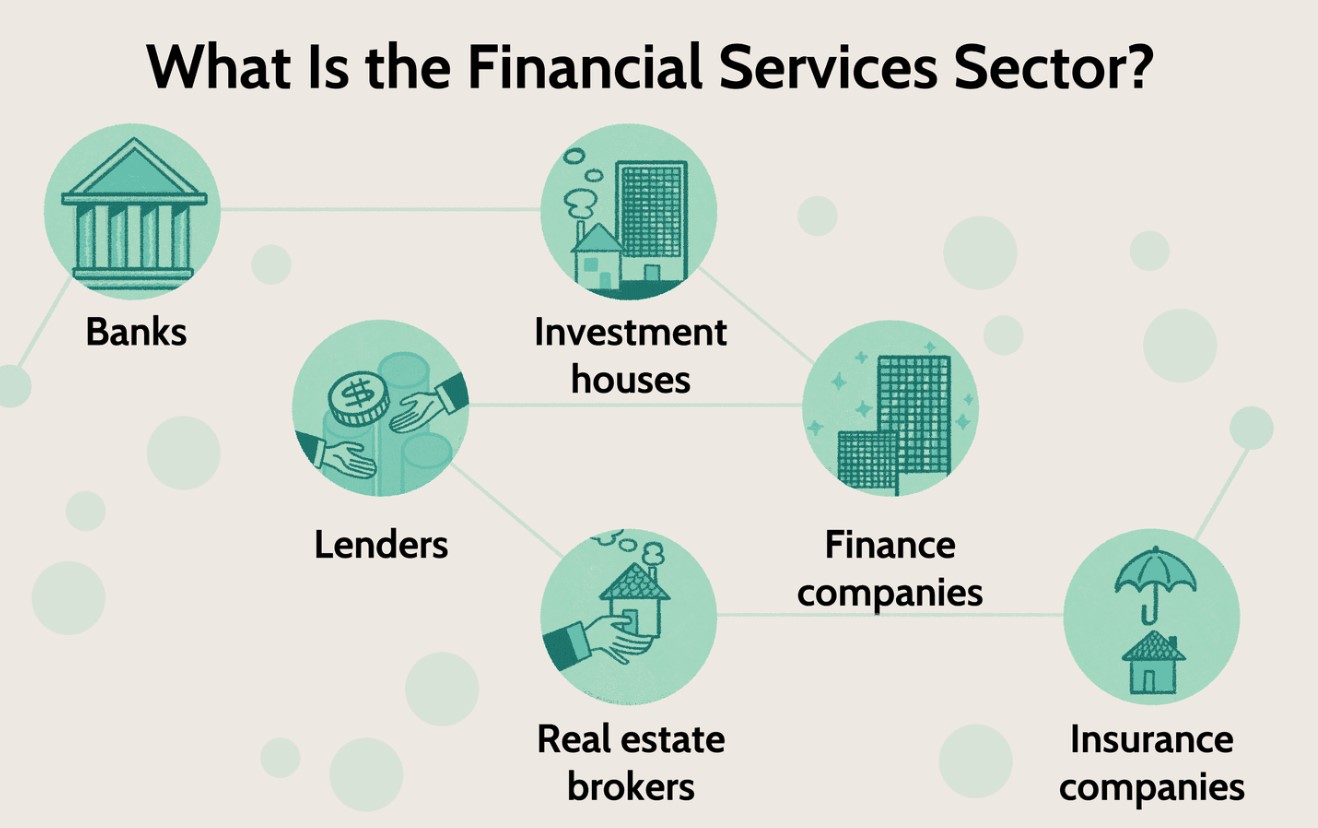

The finance industry is home to a large number of businesses that offer a variety of financial services, including banking, investing, insurance, and more. Among the leading players in this industry are:

A leader in worldwide banking and financial services, JPMorgan Chase & Co. provides a wide range of services, such as investment banking, asset management, and retail banking.

Goldman Sachs is well known for its services in investment banking, securities, and investment management, which it offers to businesses, governments, and private citizens.

Warren Buffett is the CEO of Berkshire Hathaway, a global company with holdings in insurance, investment management, and different business ventures.

Visa Inc.: A significant player in the payments sector that offers electronic funds transfer services and supports safe online transactions everywhere.

BlackRock: The biggest asset management company in the world, providing institutional and private investors with a variety of financial products and services.

Millions of consumers are served globally by the international financial services corporation Allianz SE, which specialises in asset management and insurance.

Morgan Stanley is renowned for its wealth management and investment banking services, which it offers to businesses, institutions, governmental agencies, and private citizens.

Prudential Financial: Provides a range of financial services and goods, mostly in the insurance industry. It also provides investment management and retirement planning.

Investing, trading, and retirement planning are just a few of the financial services offered by Charles Schwab Corporation, a brokerage and banking company.

American Express is a leading provider of financial services with a wide range of products, including credit cards, charge cards, and traveler’s checks.

These businesses only scratch the surface of the vast financial industry, and each makes a distinct contribution to the global financial ecosystem.

Exeter Finance: A provider of financial services with a focus on subprime auto lending is Exeter Finance. It offers financing options to people with bad credit records, enabling them to buy cars. Exeter was founded in 2006 with the goal of providing easily accessible auto loans while controlling credit risk. Please verify any current developments as of September 2021, the date of my most recent knowledge update.

Individuals can obtain personal loans and other credit-related goods through Mariner Finance, a provider of financial services. Mariner Finance focuses on offering quick and accessible lending choices in an effort to help clients manage their financial needs and accomplish their objectives.

With the help of Snap Finance, a digital lending platform, people with bad credit can obtain financing and shop at partner merchants. It offers an alternative to conventional financing strategies and places a strong emphasis on flexibility and accessibility, making it possible for people to obtain financing for retail purchases despite having a bad credit history.

A division of TD Bank Group, TD Auto Finance focuses on providing auto financing options. It offers dealer financing services as well as loans and leasing options for those buying cars. A variety of financial services and products are provided for the automotive sector by TD Auto Finance, which has operations in both Canada and the US.

Auto Loans & Car Financing

The process of obtaining finances to buy a car is referred to as car financing. It entails taking out a loan from a lender, usually a bank or other financial organisation, to pay for the purchase of the car. After that, for a fixed amount of time, the borrower makes regular monthly payments, which also include interest, to repay the loan. With this choice, people can drive while spreading out the expense over time, which makes it more reasonable for many.

Personal finance is the management of a person’s financial assets, which includes setting up a budget, saving money, making investments, and making wise financial decisions. Setting financial objectives, making a budget, keeping tabs on spending, handling debt, and making plans for retirement or other costs in the future are all part of it. Gaining good personal finance knowledge helps increase financial security and stability.

Leave a Reply